Though still a small part of the overall interconnect market, Thunderbolt-equipped hardware shipments surged 300 percent over the past year, according to IDC.

There were roughly 20,600 Thunderbolt units shipped in the second quarter of 2012, representing a little over 0.1 percent of all personal and entry-level storage (PELS) devices shipped. In the second quarter of 2013, Thunderbolt-enabled storage device shipments grew to about 0.6 percent of the market, according to IDC analyst Liz Conner, a 411 percent increase.

IDC predicted in its first quarter report that Thunderbolt, which offers 10Gbps interface speeds, could skyrocket to 5.7 percent of the PELS market by 2017. But the dominant interface will remain USB.

USB in the PELS market grew by 11.5 percent year over year in the second quarter. Ethernet also saw strong shipment growth, posting a 10.2 percent growth rate in the same time frame.

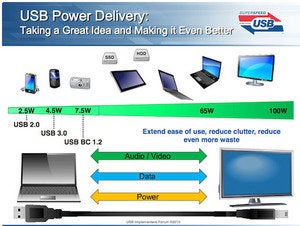

The SuperSpeed USB 3.1 specification was recently published (download the zip file here) and jumps I/O throughput (on paper) from 4.8Gbps (in USB 3.0) to 10Gbps, bringing it on par with today’s Thunderbolt specification. The next USB will also eliminate the need for power cords as the first USB Power Delivery specification is expected to boost the power from 10 watts to 100 watts across Power Delivery-certified USB cables. That spec is currently being tested by equipment developers.

Earlier this year, however, Intel also announced that its Thunderbolt specification would double data transfer speeds, opening up peripheral pipes to greater throughput.

“Thunderbolt is definitely growing, but it’s hit a few speed bumps along the way,” Conner wrote in an email to Computerworld.

Unleashing Thunderbolt

Thunderbolt sales have suffered in part because of higher prices compared to USB devices, and “people initially assumed it was an Apple only interface (and it took a while for a PC version of Thunderbolt to be introduced),” Conner said.

Hard disk drive prices were also affected by the 2011 Thailand floods, which shut down manufacturing and resulted in drive shortages. That bumped drive prices higher, pushing consumers toward cheaper options, “which really squeezed out Thunderbolt unless the higher speed was a necessity,” Conner said.

Thunderbolt will definitely continue to grow, Conner continued, but more as a replacement for Firewire/1394 and eSATA, not as a replacement to USB.

The speed of Thunderbolt is definitely sought by media professionals and other niche users who really need top-level performance, Connor said. But USB 3.0’s speed continues to be “good enough” for most users. That, plus the fact that USB 3.0 is backwards compatible, makes it significantly cheaper than Thunderbolt.

At the same time, the worldwide market for personal and entry-level storage hardware saw double-digit growth in the second quarter of 2013. The market includes storage products that range from a single disk through twelve-drive bay storage arrays marketed for individuals, small offices/home offices, and small businesses.

Global storage market

The worldwide market grew 10.7 percent year over year with 16.8 million units (worth £950 million) shipped in the second quarter, according to IDC’s PELS tracker.

It was the third consecutive quarter of year-over-year growth, according to IDC.

“The second quarter of 2013 brought ... a return to normal for the personal and entry-level storage market,” Conner said. “For the last four quarters, the PELS market has seen a distinct focus on recovery after Thailand floods.”

Drive maker Western Digital was hardest hit by the flooding, with up to 75 percent of the company’s production lines temporarily shut down by the floods, IDC said.

By the beginning of 2012, disk drive production began to recover, but prices remained inflated because of shortages. According to e-commerce tracking site Dynamite Data, the top 50 hard drives saw prices jump by 50% to 150%. The price hikes kicked off in October 2011, when inventory levels plummeted 90 percent in less than a week.

Users continue to migrate to higher capacities to meet growing storage needs. In the 3.5-in personal storage market, 2TB drives represented 51.9 percent of shipments in the quarter.

For the 2.5-inch personal storage market, 1TB drives had 51.7 percent of the market, with 4TB devices comprising 28.6 percent of units shipped.