Rush orders for solid-state drives (SSDs) increased last month in the wake of massive flooding in Thailand that caused a serious drop in hard disk drive supplies.

According to DRAMeXchange, a research division of TrendForce, rush orders for SSDs rose even as shipments of end-market products, including PCs, smartphones and tablet PCs, continued to drop because of sluggish economic conditions.

More than a dozen hard disk drive (HDD) factories have been shut due to flooding in Thailand. PC manufacturers have been bracing for significant supply shortages. Another NAND flash product, memory cards, saw a huge decline in sales due to the Thai floods, which closed down digital camera factories.

In the first half of 2011, Thailand accounted for 40 to 45 percent of worldwide hard disk drive production. As of early November, nearly half of Thailand's production was directly affected by the flooding. While production at some factories was halted, the industry also faces stoppages due to poor access and power outages.

According to market research firm IDC, the full extent of the damage to hard drive factories won't be known until floodwaters recede, although it's already clear that there will be supply shortages into the first quarter of 2012.

Hard drive prices should stabilize by June, IDC said, and the industry should be back to normal by the second half of 2012.

Fang Zhang, a storage analyst with market research firm IHS iSuppli, said the price of hard drives has been rising for both system manufacturers and consumers. In some cases, they're up more than 30 percent. But those price hikes aren't likely to drive most buyers to purchase pricier SSDs.

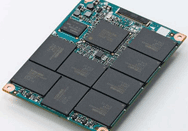

Zhang said anyone purchasing a $700 PC or laptop isn't likely to spend hundreds of dollars more on an SSD. SSDs will continue to be reserved to a niche market of high-end applications and users."SSDs are still way too expensive," she said. "They're at least 10 [times] what hard drives cost." Zhang sees more of a market for SSDs and flash memory in ultrabooks and tablets, which depend on lightweight, durable storage.

Forrester analyst Andrew Reichman agreed, saying there has been a lot of talk throughout the industry about the hard drive shortage possibly spurring SSD sales, but he's wary of that buzz. On the storage array and server manufacturing front, Reichman said vendors typically stockpile hard drives so that they have at least a five-month supply.

"There's definitely market buzz about it, but it's not that well founded. Most users are struggling with capacity growth and keeping costs down, so going out and finding ways to boost performance is not the highest priority," Reichman said.

According to Forrester, SSDs can be up to 10 times more expensive than hard drives; other research firms peg the costs far higher. Market research from other firms such as iSuppli and Objective-Analysis shows SSD pricing averages around $17 per gigabyte; it's expected to drop to $12 a gigabyte next year and to $5 per gigabyte by 2015. By comparison, a Fibre Channel or SAS drive costs 50 cents to 60 cents per gigabyte. A consumer-class SATA hard drive sells for under 10 cents per gigabyte.

The uptick in rush orders for SSDs will not be enough to revive a NAND flash market that is slumping, according to iSuppli. The contract price paid for NAND flash by system manufacturers in the second half of November dropped by 4 to 6 percent compared to the first half to the month, DRAMeXchange stated.

Even so, major PC brands, such as Hewlett-Packard, Acer, Asus, Toshiba and Lenovo also launched their ultrabooks in October and November, which use only SSDs with capacities from 64GB to 128GB. The only exception to those vendors is Asus, which offers both hard drives and SSDs in its ultrabooks.

However, the high costs of Ultrabooks' components and the wide price gap between ultrabooks and mainstream notebooks in the market seemed to hurt sales, which in turn caused SSD shipments to fall short of expectations.